Virtual | Start Date: February 4, 2026

FDD Bootcamp - Live Virtual

“I really enjoyed the entire training. It was extremely interactive and the lecturers were super engaging. They knew the answers to every question and really knew the material they were teaching. I really enjoyed how simple/dumbed down the concepts were, that made it very easy to learn concepts. Overall, I feel like I learned a lot and it was super helpful.” – FDD Bootcamp Participant

Duration:6 Live Virtual Sessions + M&A Bootcamp Digital

CPE Credits: 29 hours Live Virtual & 13 hours Digital

Experience Level:Emerging M&A Pros

What I will learn?

- Perform QofE analysis (identify EBITDA adjustments), NWC analysis, & identify debt & debt-like items using real-world case studies.

- Ensure financial accuracy by cleaning & reconciling data, understanding the importance of cash proofs, & performing TB level analysis.

- Analyze how investor types, capital sources, and deal stages shape M&A priorities and due diligence.

- Understand the FDD process, including timelines, buy side vs. sell side differences, tailoring IRLs, processing VDRs, creating databooks, & more.

- Gain a clear understanding of deal stages, key players, and how to proactively manage and add value to every step of the transaction.

- Apply proven frameworks to structure analyses, produce superior work product, & deliver insights that drive better decisions and deal outcomes.

About The Course

Week 1

Wed & Fri

Week 2

Mon, Wed, & Fri

Week 3

Mon

Build a powerful FDD foundation—This hybrid course includes our ~10-hour asynchronous, digital M&A Bootcamp paired with our virtual synchronous FDD Fundamentals for the full FDD Bootcamp experience.

Participants will receive the 360-degree view of the overall M&A process from M&A Bootcamp with a detailed understanding of the financial due diligence process and the necessary ‘how to’ tools to perform insightful financial analysis and due diligence from FDD Fundamentals to create a powerful FDD foundation for newer FDD professionals.

CPE credits are available for each course individually*. See below for course requirements, CPE details, and FAQs.

After completion of the self-paced M&A Bootcamp digital materials, the live virtual sessions start on February 4, 2026. Each session begins at 12:30 Eastern. Sessions last three to five hours. The complete schedule with dates and times is available on the registration page.

Course Curriculum

- Habits That Create Value & Their Applicability to Careers in M&A

- Personal Execution Process: Imagining & Managing the Day©

- Fundamentals: Active Reading, Listening, & Note-taking

- Fundamentals: Synthesize & Reflect

- Fundamentals: The Art of Asking Good Questions

- Fundamentals: Framing, Language, & Communication

- Cast of Characters: Buyers & Sellers, and Their Many Advisers

- Financial vs. Strategic Investors Different Types of Investors & Form of Investment

- Where Investors Sit Along the Risk / Reward Continuum

- Primary vs. Secondary Capital

- Pre-Money vs. Post-Money Valuations

- Business Lifecycle & The Investment Continuum

- Major Milestones in the Transaction Process

- Common Diligence Workflows & Third-Party Advisers

- M&A Process Considerations & Impact

- Diligence Advisory Firms & Process Type

- Introduction to Foundational Questions©

- Foundational Questions© as the Question Behind the Question

- Project / Client Foundational Questions©

- Company / Target Foundational Questions©

- Foundational Questions© Exercise

- How Businesses are Valued

- Relative and Absolute Value

- Free Cash Flow (“FCF”)

- Three Sought-After Attributes of FCF

- Desirable Business Traits & Their Impact on FCF

- The Importance of Perspective

- Risk & Opportunity

- Billionaires Brawl

- Varied Acquisition Strategies (Serial vs. Episodic Acquirers)

- Transformative Acquisitions vs. Tuck-in Strategies

- M&A Diversification Strategies

- Vertical vs. Horizontal Integration Strategies

- Strategic Acquisition Rationale

- Different Types of Synergies (Hard vs. Soft Synergies)

- Other Select Considerations

- Private Equity vs. Institutional Private Equity

- Private Equity by the Numbers: PE’s Prominence & Reach

- How a Buyout Works

- How Institutional Private Equity Works

- Investment Horizon / Hold Period

- Private Equity as Patient Capital

- How PE Firms are Structured: A Simplified Example

- Private Equity Firm Activities

- The Investment Box / Investment Criteria

- Understanding the Private Equity Deal Funnel

- Fees Charged by PE Firms to Portfolio Companies

- How Private Equity Returns Are Measured

- Three (Legal) Ways Private Equity Funds Make Money

- Understanding Add-ons & Roll-up Strategies – Examples

- Due Diligence Defined

- Intuition Building: Due Diligence Applied to Other Asset Purchases

- Foundational Questions© Revisited

- Prioritization & Decision Gates

- Building Intuition & Establishing Bookends Using Fermi Math

- Finding Insights in Contradictions

- SOPs Create Consistency & Efficiency

- Using Checklists to Reduce Error Rates

- Select Examples of Diligence Gone Wrong

- PowderCo/BeverageCo Case Study: Team Exercise & Class Discussion

- Prioritizing & Identifying Key Business & Diligence Issues

- Understanding Revolving Line of Credit / Borrowing Base Mechanics

- Diligence Scoping Best Practices

- Identifying Business Characteristics & Their Impact on Value

- Team Exercise and Class Discussion / Presentation

*This is not part of the standard M&A Bootcamp course, but it is an available add-on selected by some clients given the interactive collaborative nature of the case. This add-on requires a little pre-work (actively reading a detailed case).

- Project Magnolia - Case Introduction

- Best Practices: Creating the Databook (Converting TB into Flat file, Check, etc.)

- Excel Case Study: Project Magnolia (Customer Analysis)

- Quality of Earnings Comparison of Similar Businesses

- Normalizing Adjustments Review

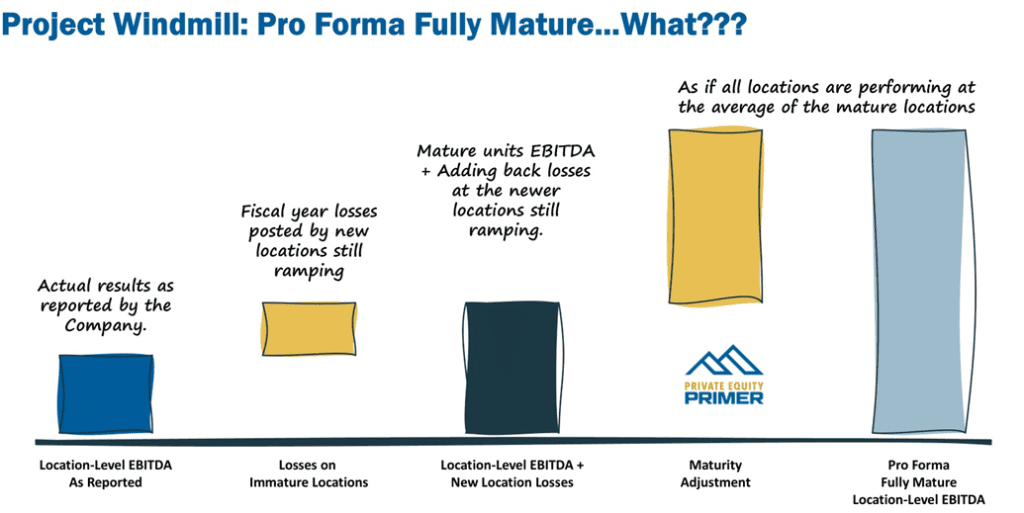

- Excel Case Study: Project Windmill (Unit Economic Model & PF Earnings Adjustment)

- Participant Earnings Base Negotiation Exercise

- Excel Case Study: Project Magnolia (Quality of Earnings Exercise)

- Review of Debt and Debt-Like Items Schedule

- Excel Case Study: Project Toledo (Debt & Debt-Like Items)

- How NWC Impacts Purchase PriceNWC as a Purchase Price Adjustment Mechanism

- NWC in Seasonal Businesses

- NWC as the Gas Fueling the Engine / Business

- Three Times When NWC is Commonly Calculated

- NWC Target as Necessary Condition to Evaluate Competitive Offers

- Excel Case Study: Project Empire Records (NWC Adjustments)

- How NWC Targets are Usually Set

- Select Best Practice Tips in Setting a NWC Target: Buy Side vs. Sell Side Considerations

- NWC Improvements as a Value Creation Tool

- How NWC Targets are Usually Set

- Example Adjusted NWC Schedule from FDD Report

- Determining Adjustments to NWC: Checklist

- Importance of Monthly Consistence in Setting NWC Targets: Example Checks in Transit

- Possible Adjustments: Cash-Free, Debt-Free Concept

- Possible Adjustments: Cash

- Possible Adjustments: Debt (Definitional vs. Debt-Like)

- Possible Adjustments: Gray Area Example–Deferred Revenue

- Possible Adjustments: Income Tax Assets & Liabilities

- Possible Adjustments: Sub-Account Details & Management Fees

- Possible Adjustments: One-Time, Non-Recurring Items

- Possible Adjustments: Accounting Considerations

- Year-end Audit Adjustment Normalization Issues

- Possible Adjustments: Excluded Assets & Liabilities

- Seasonality Impact on NWC

- Negative Net Working Capital Businesses

- Revenue Growth & Decline Impact on NWC

- Excel Case Study: Project Husker (NWC Include/Exclude Activity)

- Adjusted vs. Unadjusted NWC

- Project Based Businesses & NWC: Percentage of Completion Accounting

- Guiding Question to Ask in Determining NWC Adjustments

- NWC Negotiating Tricks & Other Practical Considerations

- Excel Case Study: Project Magnolia (NWC Analysis)

- Analysis of Where the Unlevered FCF Components are Found

- Unlevered vs. Levered FCF

- EBITDA as a Proxy for FCF – Pros & Cons / Accuracy

- Excel Case Study: Project Teddy Bear (Analysis of Capital Expenditures)

- What is FDD (and What it Informs)

- Main Components of an FDD Report (Quality of Earnings, Analysis of NWC, & Debt & Debt-Like Items)

- FDD Process Overview & Timeline

- Accounting vs. Finance and Audit vs. FDD

- Differences Between Audited Financial Statements & FDD Reports

- Importance of Confidentiality & Non-Disclosure in FDD Work

- What is FDD? Getting Clear on Your Job

- What FDD Professionals Do at the Team / Profession Level

- FDD Engagement Team Responsibilities by Function

- What FDD Professionals Do at the Associate/Sr. Associate Level

- FDD Process / Project Management–A Deeper Look

- FDD Engagement Staffing Model

- Being an Independent, Unbiased Resource While Serving Your Client

- Healthy Professional Skepticism

- Roles & Responsibilities the FDD Job Does NOT Include

- Buy Side vs. Sell Side vs. Carve Out Comparisons

- The Transaction Perimeter

- Databooks vs. Reports vs. Both

- Buy Side vs. Sell Side Considerations–A Deeper Look

- Full Diligence vs. More ‘Phase I’ Type Engagements

- Branded vs. Unbranded Deliverables in Engagements

- What Buy Side & Sell Side Reports Inform

- Carve Outs

- Quality of Earnings (EBITDA Adjustments)

- Analysis of Net Working Capital (“NWC”)

- Identification of Debt & Debt-Like Items (“DDL”)

- Impact of the Main Components on Price & Terms (Trace Back to LOI and SPA)

- Example LOI Excerpts

- FDD Informs Client Perspectives on Free Cash Flow (“FCF”)

- The Primary Goal of FDD

- Core Data Sets: Trial Balances and Transaction Level Databases

- Common Starting Points: Reconciliations & Cash Proof

- Other Common Financial Analyses

- Excel Case Study: Project Lucky Day (Reconciliations)

- Why Private M&A Transactions are Normally Cash-Free, Debt-Free

- Public Company vs. Private Company Differences

- Why EBITDA is the Go-To Metric in Private M&A Transactions

- Impact of Financing Decisions

- Enterprise vs. Equity Value

- What is EBITDA?

- EBITDA and Foundational Questions

- Why EBITDA is Go-To Metric in Private M&A Transactions

- Earnings Generating Capacity (“EGC”)

- Normalizing Adjustments – Common Categories / Types of Adjustments

- Normalizing Adjustments – Example QofE Table Conventional Layout

- Excel Case Study: Project Lucky Day (Identifying EBITDA Adjustments)

- FDD Philosophical Approaches to EBITDA Adjustments

- EBITDA as a Proxy for Free Cash Flow

- Cash-Free, Debt-Free Convention

- Definition of Indebtedness from a Purchase Agreement

- Example Debt & Debt-Like Items Schedule

- What is Net Working Capital?

- Net Working Capital Example – Beverage Company (PopFizz)

- NWC Cycle / Cash Conversion Cycle

- How Businesses Finance NWC Needs

- NWC Differences by Industry and Company

- NWC Optimization

- Changes in NWC – Sources & Uses of Cash

- FDD’s Role in the Deal Process

- Competitive Auction Process vs. One-Off Negotiation

- Phase I (Key Issues) Report vs. Phase II (Full Scope) Report

- Purchase Agreement Assistance

- Process Overview and Timeline

- Typical Milestones & Timing on an FDD Engagement

- Client Internal Processes & Its Impact on FDD Project Timing

- Process Overview and Timeline

- Spinning Up the Engagement

- Receiving Preliminary Information & Completing Foundational Questions

- Understanding the Client’s Investment Thesis

- Creating the Statement of Work (“SOW”) & SOW Best Practices

- Budgeting & Hour Tracking

- Cross-Sell & Up-Sell Opportunities

- Internal Kick-Off Team Meeting

- Working Group List (“WGL”)

- Information Request List (“IRL”)

- IRL Activity, Considerations, & Best Practices

- Common High Priority Data Requests

- Initial Questions List Tips

- Data Flow & Client Communication

- Process Overview and Timeline

- Virtual Data Room (“VDR”) Access, Processing, & Best Practices

- Analysis & Databook Creation

- Common FDD Analyses (QofE / EBITDA Adjustments, NWC Analysis, DDL)

- Data Prep & Data Cleaning Tips

- Lead Sheets

- Excel Case Study: Project Lucky Day (Data Scrubbing & Customer Analysis)

- Audit Workpaper Review

- Managing Overseas Resources

- Preparing for the Management Visit

- Meeting Agendas & Question Lists

- Management Visits: On-Site vs. Videoconference

- Management Meetings

- Active Notetaking in Management Meetings & Calls

- Meeting Strategies: How to Approach Questions & Communication Tips

- Meeting Strategies: Team Roles & Responsibilities

- Management Visit Wrap-up & Follow-Up

- Employing Active Listening in Management Meetings & Calls

- Post Management Visit Activities

- Excel Case Study: Project Lucky Day (Recast Financial Statements)

- Important Figures & Metrics to Know & be Able to Recall

- Process Overview and Timeline

- FDD Report Production & Best Practices

- Distilling the Data & Prioritizing Key Findings

- Report Writing Using an Outline & Identifying Key Themes

- Report Organization: Slide Layout Considerations & Best Practices

- Applying the Pyramid Principle–Do Not Bury the Lead

- Movie Trailer: Getting Across the “So What”

- Writing is an Iterative Process: Tips on Writing FDD Reports

- Keep it Clear & Concise

- Anatomy of an Adjustment Write-up

- Adhering to SOPs to Avoid Unnecessary Rework

- Editing Tips & Best Practices

- Panning Out and Attempting to Bulletproof Your Work

- Interim Updates vs. Final Read-out Calls

- Client Read-Out Calls–Considerations & Best Practices

- Tips on Handling Tough Questions

- Becoming a Trusted Advisor, Not Just a Vendor

- Process Overview and Timeline

- Post Report Assistance

- Incorporating FDD Findings into Client Valuation Models

- Updating the Report / Rolling Forward Data & Analysis

- Completing Calls with Third Parties (e.g., lenders, RWI providers)

- Purchase Agreement Guidance & Post-Close NWC Assistance

- Preparation of Closing NWC Schedule, True-up Calculations, & Advising on Potential Disputes

- Potential Follow-up Work / Cross-Sell Related Services

- After Action Review

M&A Professions

- Financial Due Diligence

Course Requirements

To ensure an effective learning experience for all participants, the following requirements must be met:

- Personal Computer Running Microsoft Excel (PC required). We strongly advise against using a Mac. Excel hotkeys differ on Macs, and Mac-specific commands and will not be taught as part of this course.

- Full-Sized Keyboard Recommended. Keyboards with single-function F-keys and a full ten-key number pad greatly improve efficiency for Excel-based exercises.

- Two (2) Computer Monitors are Required. This allows participants to simultaneously view the instruction screen and complete exercises in Excel or other tools as directed.

- Functioning Computer Camera. Cameras must remain on throughout all live sessions. Failure to comply may result in removal from the course without refund.

- Reliable High-Speed Internet. Reliable, high-speed internet connection that supports continuous video and audio streaming.

- Ability to Log into a Microsoft Teams. Access to Microsoft Teams videoconference (or similar service as may be used by PE Primer from time to time).

- Timely Completion of Asynchronous Material. Participants must complete the asynchronous digital M&A Bootcamp material before the first live virtual session.

Environment & Participation

- Quiet, Professional, Non-Public Workspace. Make sure your workplace is a quiet, professional, and non-public location without visual or auditory distractions. Headphones with a microphone may be necessary based on your setup.

- Active Participation is Required. Participants are expected to:

- Ask and answer questions,

- Offer perspectives during discussions,

- Contribute meaningfully to group work, and

- Engage fully during case studies and Excel exercises.

CPE Credits

Details

- Last Updated January 2025

- CPE Credit 13

- Field of Study Finance (10.0 CPE) / Management Services (2.5 CPE) / Personal Development (0.5 CPE)

- Instructional Delivery Method QAS Self-Study

- Knowledge Level Basic

- Prerequisites None

- Advanced Preparation None

Refund Policy

For more information regarding refunds, concerns, and program cancellation policies, please contact the Private Equity Primer Support Team via email at help@pe-primer.com.

Compliant Resolution

For any complaints or issues with course materials or delivery, please email the Private Equity Primer Support Team at help@pe-primer.com.

NASBA Sponsor Statement

Private Equity Primer is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org

Details

- Last Updated November 2024

- CPE Credit 29

- Field of Study Finance (25.0 CPE) / Management Services (2 CPE) / Personal Development (1.5 CPE) / Communications & Marketing (0.5 CPE)

- Instructional Delivery Method Group Live

- Knowledge Level Basic

- Prerequisites None

- Advanced Preparation None

Refund Policy

For more information regarding refunds, concerns, and program cancellation policies, please contact the Private Equity Primer Support Team via email at help@pe-primer.com.

Compliant Resolution

For any complaints or issues with course materials or delivery, please email the Private Equity Primer Support Team at help@pe-primer.com.

NASBA Sponsor Statement

Private Equity Primer is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org

FAQs

Yes. Both versions cover substantially the same material. The primary difference is the delivery format.

In the Live Virtual course, the first part of the course (M&A Bootcamp) is provided as asynchronous digital content that must be completed before the first live session. The remaining content is delivered through scheduled live sessions on Microsoft Teams.

Both versions use multiple instructional methods: lecture, group work, case studies, and hands-on Excel analysis.

Participants should expect the following time commitments:

- Asynchronous Digital Content (M&A Bootcamp): Approximately 10–12 hours to complete. This must be finished prior to the first Live Virtual session.

- Pre-Reading of Preliminary Deal Documents: Participants must review a set of preliminary deal documents (e.g., CIM, sell side QofE, LOI) before the Live Virtual sessions begin. This typically takes 1–3 hours, depending on familiarity with the materials.

- Live Virtual Sessions: The course includes six (6) scheduled Live Virtual sessions delivered over several weeks. Each session lasts approximately 3–5 hours, depending on the specific content covered.

The course is designed for professionals new to financial due diligence (“FDD”) or transaction advisory services (“TAS”), as well as early-career FDD/TAS professionals with up to a few years of experience. However, sometimes we have entire FDD deal teams take this course together.

Yes. Each participant must register and purchase their own seat and must join using their own computer. Shared seats, screen sharing, projecting, relaying, recording, or any other form of shared or distributed access are strictly prohibited.

Yes. Anyone may purchase a seat, but each must have their own registered seat and participate from their own device.

There are no formal prerequisites, but participants must complete the asynchronous digital M&A Bootcamp material before the first live virtual session.

Recommended (but not required): Participants should have a solid working knowledge of Microsoft Excel. If you are not proficient with functions such as SUMIFS, XLOOKUP, EOMONTH, anchoring, paste special, filtering, sorting, etc., we recommend completing PE Primer’s M&A Excel Essentials asynchronous course beforehand.

Spacing the sessions provides participants time to absorb the material and reduces videoconferencing fatigue. It also allows participants to maintain progress on active client engagements rather than being away from work for several consecutive days.

Yes. Participants receive a hard copy workbook before the course begins. Shipping outside the continental U.S. or expedited shipping may incur additional fees. Digital copies will not be provided.

Live sessions are group-based. While we understand that the urgency of client work, illness, or other emergencies occur, we cannot plan around all parties’ schedules. Attendance is a personal decision and responsibility. Missing any session may cause you to fall behind, and we cannot adjust the schedule for individual conflicts. There is no make-up mechanism for missed sessions.

No. Sessions are not recorded for subsequent participant use or consumption, and participants are strictly prohibited from recording audio or video. Recording constitutes a violation of the terms of service.

In its sole discretion, if PE Primer suspects a participant or participant’s firm of violating any of the terms of service, including but not limited to broadcasting, projecting, relaying, recording, saving screen shots, or having any non-registered party view or listen in on any part of the course, PE Primer may terminate access to the course without refund.

Substitutions may occur before the first live session if:

- The replacement is a full-time employee of your firm, and

- They complete the asynchronous digital content (M&A Bootcamp) before the course begins.

If the original participant started the digital content, additional fees apply. Additional workbook printing/shipping may also incur fees.

Cancellations are not allowed, and seats are not transferable to future sessions.

Benefits Obtained :

- Training Without Travel

- Master Core FDD Analyses

- Available to Offshore Teams & Resources

- Apply Real-World Techniques

- Excel in Deal Execution

- CPE Credit

Not ready to join? Sign-up to be kept up to date on new training dates.

Have questions? Email us at info@pe-primer.com.

SHARE :

Private Equity Primer is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: NASBAregistry.org.

Join the Waitlist

We'll reach out when future dates become available.